Secure your future today. Take control of your retirement savings with Voya Financial. Visit www.voyaretirementplans.com and register now to access your employer-sponsored retirement plan and start building a brighter tomorrow.

Retirement may seem like a distant horizon, especially for young professionals just starting their careers. However, securing your financial future requires taking proactive steps early on. One of the most crucial decisions you can make is enrolling in your employer-sponsored Voya retirement plan. This article will serve as your comprehensive guide to navigating the registration process and unlocking the power of your Voya plan.

Why enroll in your Voya plan

For instance, if you’re considering a Voya traditional IRA, you’ll enjoy tax-deductible contributions that can lower your taxable income and potentially reduce your tax bill. When you invest your contributions, your money grows over time through compounding interest, meaning you earn interest on your contributions and on the interest you’ve already earned.

Many employers offer Voya 401(k) plans, which allow you to contribute a portion of your pre-tax salary to your retirement savings. Your employer may also match a portion of your contributions, essentially giving you free money to boost your retirement savings.

Both traditional IRAs and 401(k) plans offer a variety of investment options, so you can choose a portfolio that aligns with your risk tolerance and investment goals. And, if you leave your job, you can typically roll over your Voya retirement savings into another retirement plan, such as an IRA or another employer’s plan, to avoid taxes or penalties.

Voya also offers a variety of other retirement plans, such as Roth IRAs and employer-sponsored Roth 401(k) plans. With these plans, your contributions are not tax-deductible, but your withdrawals in retirement will be tax-free. This can be a good option if you expect to be in a higher tax bracket in retirement.

No matter which Voya retirement plan you choose, one of the biggest benefits is that it can help you achieve financial security in retirement. Having a nest egg can help you maintain your lifestyle after you stop working and cover your living expenses.

Benefits of enrolling in Voya retirement plan

Voya offers a variety of retirement plans, so the specific benefits of enrolling will depend on the plan you choose and your employer’s contributions. However, there are some general benefits of participating in any Voya retirement plan:

Tax advantages:

Contributions to your Voya retirement plan are typically tax-deductible, which can lower your taxable income and potentially reduce your tax bill.

Compounding interest:

When you invest your retirement contributions, your money grows over time through compounding interest. This means you earn interest on your contributions, and you also earn interest on the interest you’ve already earned.

Potential employer match:

Many employers offer to match a portion of your contributions to your Voya retirement plan. This is essentially free money, so it’s a great way to boost your retirement savings.

Variety of investment options:

Voya offers a wide range of investment options, so you can choose a portfolio that aligns with your risk tolerance and investment goals.

Portability:

If you leave your job, you can typically roll over your Voya retirement savings into another retirement plan, such as an IRA or another employer’s plan. This helps you avoid paying taxes or penalties on your savings.

Professional guidance:

Voya offers a variety of resources and tools to help you plan for your retirement. This includes retirement calculators, investment advice, and educational materials.

Financial security:

The biggest benefit of participating in a retirement plan is that it can help you achieve financial security in retirement. Having a nest egg can help you maintain your lifestyle after you stop working and cover your living expenses.

Step-by-step www.voyaretirementplans.com register now

1. Gather Information:

- Obtain your employee ID and other relevant information from your Human Resources department.

- Familiarize yourself with your Voya plan options, including contribution limits and investment choices.

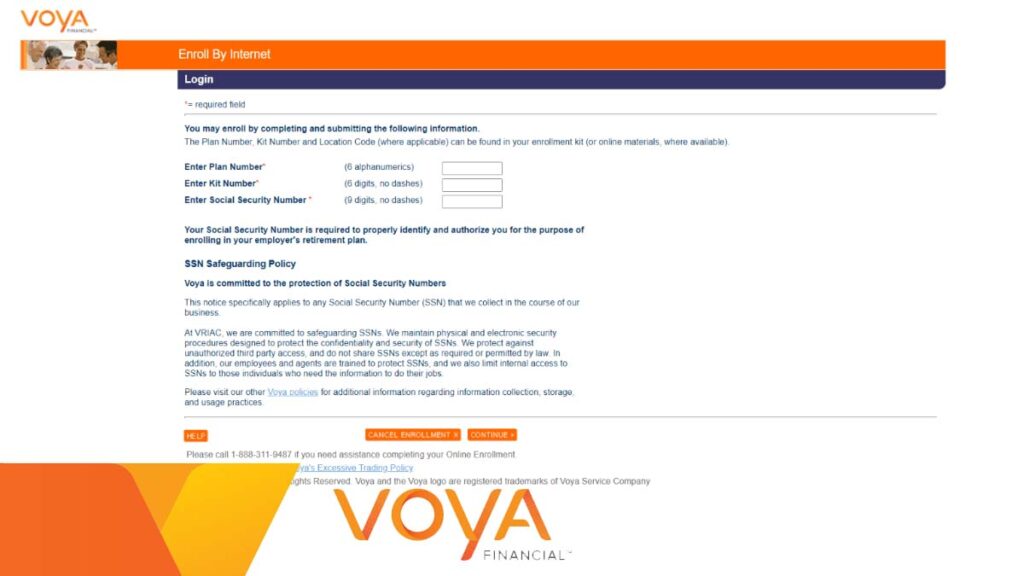

2. Access the Voya website:

- Visit the Voya website dedicated to your employer’s plan. You can usually find the link through your company’s intranet or by contacting Human Resources.

3. Create an Account (if new):

- Provide your personal information and choose a secure password.

4. Complete the Enrollment Form:

- Select your desired contribution amount and investment options.

- Review your beneficiary information and ensure it is accurate.

- Electronically sign the enrollment form.

5. Congratulations! You’re Enrolled!

Remember, enrolling is just the first step. Regularly review your Voya plan contributions and investment choices to ensure they align with your evolving financial goals and life circumstances. Don’t hesitate to seek guidance from Voya’s financial advisors or online resources if you need personalized support.

Tips for Choosing the Right Investment Options

- Assess your risk tolerance: Consider your ability to handle market fluctuations and choose investments that align with your comfort level.

- Define your retirement goals: Determine how much you need to save and when you plan to retire to guide your investment selection.

- Seek professional advice: Consult with a financial advisor for personalized recommendations based on your individual circumstances.

FAQs

Can I contribute more to my Voya retirement plan?

Whether you can contribute more to your Voya retirement plan depends on several factors:

- Plan type: Contribution limits vary by plan type. For example, traditional IRAs have different limits than 401(k) plans.

- Current contributions: Your current contribution level compared to the annual limit determines the potential remaining room.

- Catch-up contributions: If you’re age 50 or older, you may be eligible for catch-up contributions that allow exceeding the standard limit.

- Employer match: Some employers match a portion of your contributions, potentially affecting your available contribution space.

What happens if I don’t enroll in my Voya retirement plan?

Missing enrollment in your Voya retirement plan has several potential consequences:

- Missed tax benefits: Contributions to Voya plans are often tax-deductible, lowering your taxable income and potentially reducing your tax bill. Skipping enrollment means missing out on these benefits.

- No employer match: If your employer offers a match, not enrolling means forfeiting this free money that could significantly boost your retirement savings.

- Lower retirement income: Without accumulating retirement savings through your Voya plan, you might face financial challenges in your later years and rely solely on Social Security or other income sources.

- Limited investment opportunities: Voya plans often offer diversified investment options unavailable in personal savings accounts. Missing out on these can mean a less robust retirement portfolio.