Will Home Loan Interest Rates Go Down in 2024? In 2023, home loan interest rates surged after years of historic lows. But what does 2024 hold for prospective homebuyers? This article dives deep into the factors influencing interest rates and explores expert predictions for the rest of the year.

Current Mortgage Rate Trends

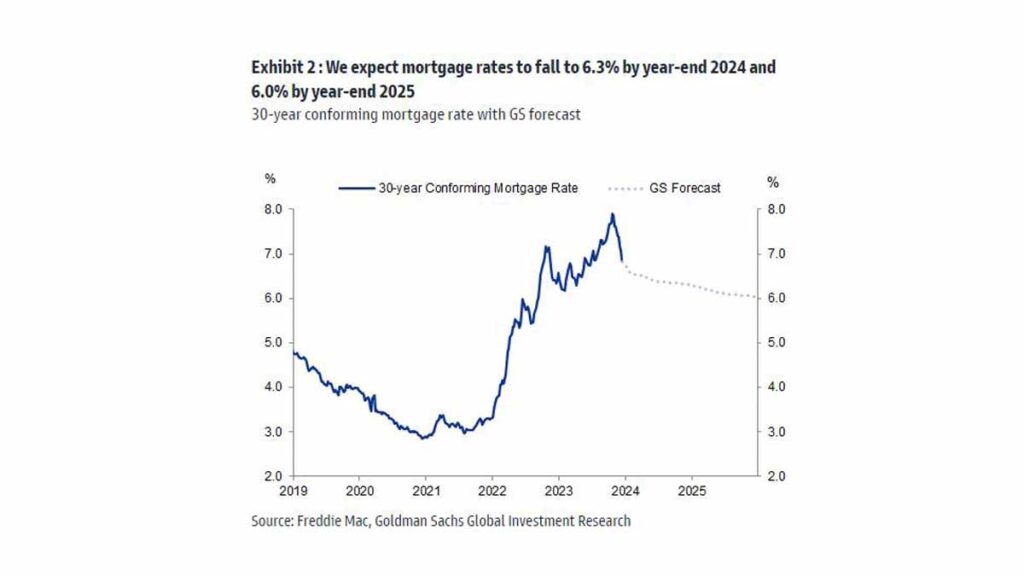

While rates soared in 2023, there have been recent signs of a potential decline. After hitting a 23-year high, some lenders are reporting a slight decrease. However, it’s important to remember that the market can be volatile, and short-term fluctuations don’t necessarily guarantee a long-term downward trend.

Understanding Interest Rate Fluctuations

Home loan interest rates are impacted by a complex interplay of economic forces. Here are some key players:

Federal Reserve Policy

The Federal Reserve (Fed) influences interest rates by raising or lowering its federal funds rate. When inflation is high, the Fed typically raises rates to slow down borrowing and spending. Conversely, the Fed may lower rates to stimulate the economy during sluggish periods.

Economic Conditions

A strong economy with low unemployment can lead to rising interest rates. On the other hand, a recessionary environment might prompt the Fed to lower rates to encourage borrowing and investment.

Inflation

Inflation, the rising cost of goods and services, is a major concern for the Fed. If inflation is high, the Fed is likely to raise rates to curb it.

2024 Interest Rate Forecasts

While predicting the future is never foolproof, here’s what some housing experts anticipate for the remainder of 2024:

- Potential Rate Decreases: Many experts believe interest rates may decrease as the year progresses. This is contingent on inflation subsiding and the economy potentially softening.

- Rates Still Above Historical Lows: Even with a decline, interest rates are likely to remain higher compared to the record lows witnessed in recent years.

Should You Wait or Buy Now?

The decision of whether to wait or buy a house depends on your individual circumstances. Here are some factors to consider:

- Financial Situation: Can you comfortably afford a mortgage payment at current interest rates?

- Urgency to Buy: Do you have a pressing need to move, or is buying flexible for you?

- Market Conditions: Is the housing market competitive in your area? Are there signs of a slowdown?

Tips for Making a Decision

- Get Pre-Approved: Pre-approval allows you to understand how much you can borrow and shows sellers you’re a serious buyer.

- Talk to a Mortgage Lender: A qualified lender can explain different loan options and current rates.

- Consider All Costs: Factor in closing costs, property taxes, and homeowners insurance in addition to the mortgage payment.

FAQs

Will interest rates definitely go down in 2024?

There’s no guarantee. The Fed’s actions and economic conditions will significantly influence interest rates.

Should I wait to buy a home if I expect rates to drop?

This depends on your individual circumstances. Waiting for a lower rate might save you money, but housing prices could also continue to rise. Consider factors like your financial stability, urgency to move, and the local housing market.

How can I stay updated on interest rate trends?

Monitor financial news websites, follow mortgage lender blogs, and sign up for lender rate alerts.

What steps can I take to get a good interest rate on a home loan?

Improve your credit score, save for a larger down payment, and compare rates from multiple lenders.

Remember: Consulting a qualified mortgage professional is crucial for personalized advice tailored to your financial situation and homeownership goals. They can help you navigate current rates and guide you through the home loan process.

Conclusion

While predicting the future of mortgage rates is challenging, staying informed and having a solid financial plan are key. By considering expert analyses, your personal circumstances, and the current housing market, you can make a well-informed decision about buying a home in 2024.

Check Out