Can Insurance Cover Lasik? Lasik, a revolutionary vision correction procedure, has transformed countless lives by eliminating the dependence on glasses or contact lenses. However, the cost of this advanced surgery can be a significant financial burden. This is where the question of insurance coverage arises. Many individuals wonder if their health insurance plans will cover the expenses associated with Lasik. This inquiry is understandable, considering the potential financial implications of such a procedure.

The following exploration will delve into the intricacies of insurance coverage for Lasik, examining factors that influence eligibility, the types of plans that typically offer coverage, and the potential out-of-pocket costs involved. By understanding these aspects, individuals can make informed decisions about their vision correction options and financial planning.

Understanding LASIK and Insurance

LASIK is considered an elective procedure, meaning it’s not medically necessary to correct vision problems. Because of this, most health insurance plans don’t cover the cost.

What is LASIK?

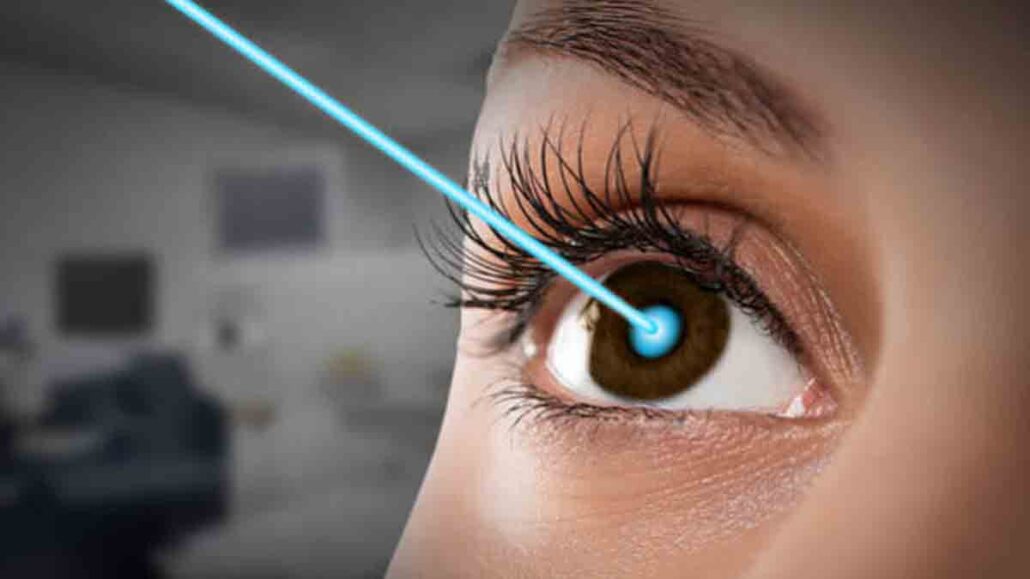

LASIK (Laser-Assisted In-Situ Keratomileusis) is a refractive surgery that reshapes the cornea to correct vision issues like nearsightedness, farsightedness, and astigmatism.

Why Isn’t LASIK Typically Covered?

Most insurance plans, both health and vision, consider LASIK an elective procedure, meaning it’s not medically necessary. Hence, it’s often excluded from coverage.

However, there are a few scenarios where coverage might be possible:

- Vision insurance: Some vision insurance plans offer discounts or rebates on LASIK procedures. These benefits vary widely by provider and plan.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): These accounts allow you to set aside pre-tax dollars for eligible medical expenses, including LASIK.

- Employer-sponsored programs: Some employers offer vision benefits or discounts on LASIK as part of their employee wellness programs.

Factors Affecting LASIK Insurance Coverage

Several factors can influence whether or not your insurance might cover LASIK:

- Type of insurance: Health insurance typically doesn’t cover LASIK, but vision insurance might offer discounts.

- Specific plan details: Even within vision insurance plans, coverage for LASIK can vary.

- Medical necessity: In rare cases, if LASIK is deemed medically necessary due to an underlying condition, it might be covered by health insurance.

How to Maximize Your Insurance Benefits for LASIK

To make the most of your insurance benefits for LASIK:

- Review your insurance policy: Carefully examine both your health and vision insurance plans to understand any potential coverage or discounts.

- Contact your insurance provider: Directly inquire about LASIK coverage and any available discounts or programs.

- Consider a vision insurance plan: If you don’t have one, explore vision insurance options that offer LASIK discounts.

- Utilize FSAs or HSAs: Contribute to these accounts to save pre-tax dollars for LASIK expenses.

- Check with your employer: Inquire about any employer-sponsored vision benefits or discounts.

Financing Options for LASIK

If insurance doesn’t cover LASIK, several financing options are available:

- Health Savings Accounts (HSAs): These accounts can be used for qualified medical expenses, including LASIK.

- Flexible Spending Accounts (FSAs): Similar to HSAs, but funds are typically allocated annually.

- Low-Interest Financing Plans: Many LASIK providers offer financing options with manageable monthly payments.

- Credit Cards: While not ideal due to potential interest charges, credit cards can be used in emergencies.

Frequently Asked Questions (FAQs)

Will my health insurance cover LASIK?

Typically, no. LASIK is considered an elective procedure and is not usually covered by standard health insurance plans.

Can I use my vision insurance for LASIK?

Some vision insurance plans offer discounts or rebates for LASIK. Check with your provider to see if your plan has this benefit.

Can I use an FSA or HSA for LASIK?

Yes, you can use funds from an FSA or HSA to pay for LASIK as it’s considered a qualified medical expense.

Are there any medical conditions that might make LASIK covered by insurance?

In rare cases, if LASIK is deemed medically necessary due to an underlying condition, it might be covered by health insurance.

How much can I expect to save with vision insurance for LASIK?

Discounts vary widely by insurance provider and plan. You’ll need to check your specific plan for details.

Conclusion

While insurance typically doesn’t cover LASIK, there are exceptions and opportunities to reduce costs. Understanding your insurance policy, exploring financing options, and comparing prices can help you make informed decisions about this life-changing procedure. Always consult with your eye care professional and insurance provider for personalized advice.