Tired of running errands to the bank? Craving 24/7 access to your finances? Look no further than Cathaybank.com Online Banking, your one-stop shop for convenient, secure, and efficient financial management. With a user-friendly interface and a range of powerful features, Cathaybank.com Online Banking empowers you to take control of your money, anytime, anywhere.

Here’s a glimpse of what awaits you:

- Unleash your inner banker: Manage your accounts with ease, from checking your balance and reviewing transactions to transferring funds and paying bills.

- Schedule with confidence: Set up automatic bill payments and recurring transfers, ensuring you never miss a beat.

- Send with speed and security: Utilize Zelle®, a fast and convenient way to send money directly to friends and family in the U.S.

- Budget like a pro: Access powerful financial tools to track your spending, set goals, and stay on top of your budget.

- Knowledge is power: Gain valuable insights into your financial health with detailed account statements and transaction history.

- Peace of mind guaranteed: Rest assured knowing your finances are protected by multi-layered security measures.

Cathaybank.com Online Banking is more than just a banking platform; it’s a key to unlocking your financial freedom. Ditch the long lines, embrace convenience, and experience the power of managing your money on your terms.

Benefits of Cathaybank.com online banking

1. 24/7 Access Anywhere: Gone are the days of rigid banking hours. With online banking, your accounts are accessible anytime, anywhere, from your desktop or mobile device. No more rushing to the branch before closing time!

2. Effortless Bill Pay: Conquer bill-paying woes with the integrated bill pay system. Schedule automatic payments, track due dates, and say goodbye to late fees. It’s like having a financial assistant on call.

3. Seamless Fund Transfers: Move money between your Cathay accounts or to other US banks instantly. No need for paper forms or endless phone calls – transfers are just a few clicks away.

4. Enhanced Security: Rest assured knowing your finances are protected by robust security measures. Multi-factor authentication and fraud monitoring keep your accounts safe, giving you peace of mind.

5. Money Management Made Easy: Take control of your spending with built-in budgeting and financial analysis tools. Track income and expenses, categorize transactions, and set spending goals for a clear picture of your financial health.

6. Mobile Banking on the Go: Life’s on the move, and so is your bank. Cathay’s mobile app puts convenient banking right in your pocket. Deposit checks remotely, send instant Zelle® payments, and manage your finances anytime, anywhere.

7. Personalized Alerts: Stay informed about your accounts with customizable alerts. Get notified about low balances, large transactions, and upcoming bill payments, so you’re always in the loop.

8. Paperless Convenience: Ditch the paper statements and go green. Access your statements and transaction history electronically, reducing clutter and saving the environment.

9. Account Reconciliation Simplified: Reconciling accounts shouldn’t be a chore. Cathay’s online platform makes it easy to match your transactions with statements, saving you time and frustration.

10. Dedicated Support: Need help navigating the platform or have questions about your accounts? Cathay’s friendly customer support team is always available to assist you.

Feature of Cathaybank.com online banking

1. Convenience at Your Fingertips:

- 24/7 Access: Ditch the banking hours. Check balances, track transactions, or transfer funds whenever inspiration strikes, day or night.

- Mobile Magic: Take your bank on the go! The Cathaybank mobile app brings all the online banking features to your pocket, with added perks like mobile check deposit.

- Bill Pay Simplified: Schedule and pay bills electronically, ensuring timely payments and avoiding late fees. No more envelopes or stamps needed!

2. Manage Your Money, Effortlessly:

- Account Aggregation: See the big picture. View all your Cathaybank accounts, including checking, savings, and loans, in one centralized dashboard.

- Financial Tools: Budget like a pro! Track spending, set financial goals, and analyze your transactions with built-in budgeting and analysis tools.

- Personalized Alerts: Stay informed. Set up custom alerts for low balances, upcoming bills, or large transactions, and receive notifications directly to your email or phone.

3. Security You Can Trust:

- Multi-Factor Authentication: Rest easy knowing your money is protected. Secure your login with an extra layer of verification through your phone or email.

- Data Encryption: Cathaybank uses industry-leading encryption technology to safeguard your financial information and keep it safe from prying eyes.

- Fraud Monitoring: Relax while the bank works in the background. Proactive fraud monitoring systems safeguard your accounts against unauthorized activity.

4. Beyond the Basics:

- Send Money with Zelle: Skip the checks and cash. Send and receive money securely and instantly between friends and family through Zelle integration.

- International Transfers: Need to send money overseas? Cathay bank online banking makes international transfers a breeze, with competitive rates and convenient tracking options.

- Investment Options: Grow your wealth alongside managing your everyday finances. Explore investment options directly within the online banking platform.

How to open a Cathay bank account online

Opening a Cathay bank account online is a quick and easy process that can be done in just a few minutes. Here are the steps you’ll need to follow:

- Visit the Cathay Bank website and click on the “Open An Account” button.

- Select the type of account you want to open. Cathay Bank offers a variety of checking and savings accounts, so be sure to choose the one that best fits your needs.

- Enter your personal information. This will include your name, address, date of birth, and Social Security number.

- Fund your account. You can fund your account with a transfer from another bank account or by using a debit card.

- Review your application and submit it. Once you’ve reviewed your application, make sure everything is correct and then submit it.

That’s it! Once your application is approved, you’ll be able to access your new Cathay bank account online or through the Cathay Bank mobile app.

Keep in mind when opening a Cathay bank account online:

- You must be at least 18 years old to open an account.

- You must be a U.S. citizen or resident alien.

- You will need to have a valid government-issued ID, such as a driver’s license or passport.

Cathay bank online banking login

To access Cathay Bank online banking, you have two options:

1. Through their website:

- Visit the Cathay Bank website: https://www.cathaybank.com/

- Click on the “Login to Online Banking” button on the homepage. This will take you to the secure login page.

- Enter your Login ID (for personal banking) or Company ID and Login ID (for business banking) in the designated fields.

- Enter your password.

- Click “Continue”.

2. Through their mobile app:

- Download the Cathay Bank mobile app for your Android or iOS device.

- Open the app and enter your Login ID or Company ID and Login ID.

- Enter your password.

- Click “Log In”.

Cathay bank mobile banking app

The Cathay Bank mobile banking app is a secure and convenient way to manage your finances on the go. It’s available for iPhone®, iPad®, Apple Watch®, and Android™ devices.

Here are some of the things you can do with the Cathay Bank mobile banking app:

- Check your account balances

- View recent transactions

- Transfer money between accounts

- Pay bills

- Deposit checks

- Find ATMs and branches

- Get customer support

The app is free to download and use, but there are some fees for certain services, such as mobile check deposits.

To get started, you’ll need to be an existing Cathay Bank customer and have an online banking account. Once you have that, you can download the app from the App Store or Google Play.

Overall, the Cathay Bank mobile banking app is a great option for Cathay Bank customers who want to manage their finances on the go. It’s convenient, easy to use, and secure.

CathyBank online banking customer service

CathyBank online banking customer service” can refer to a few different things, depending on what you need. Here are some options:

1. Accessing CathyBank online banking:

- Website: You can access your CathyBank online banking account directly through their website at https://www.cathaybank.com/personal/digital-banking/online-banking.

- Mobile app: CathyBank also offers a mobile banking app for iPhone and Android devices. You can download the app from the App Store or Google Play.

2. Contacting CathyBank customer service for online banking issues:

- Phone: You can call CathyBank customer service at 1-800-922-8429.

- Secure message: You can send a secure message to CathyBank customer service through your online banking account.

- Live chat: CathyBank offers live chat support on their website during business hours.

FAQs

Who is eligible for online banking?

All Cathay Bank customers with a checking or savings account can enroll in online banking.

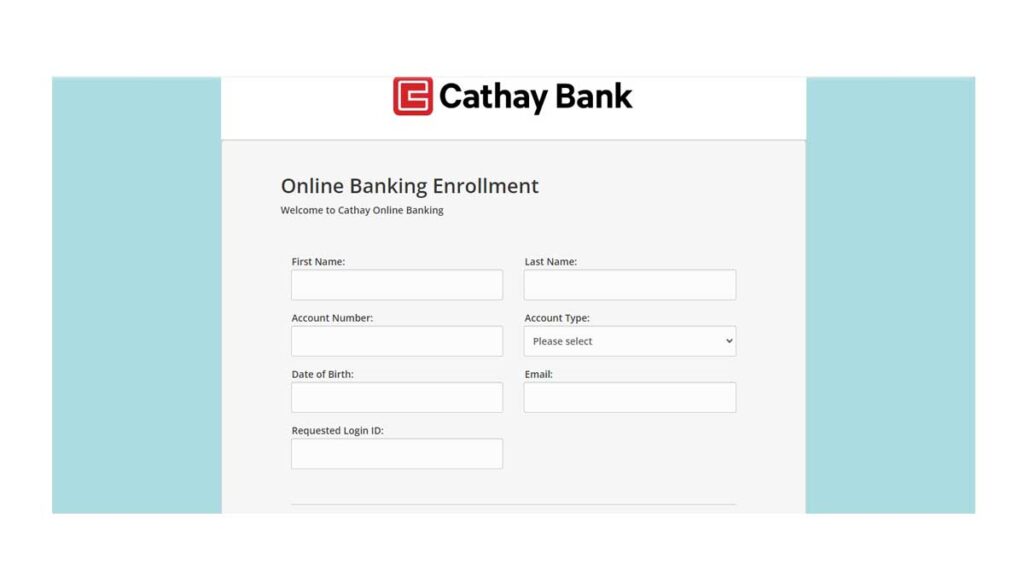

How do I enroll in online banking?

You can enroll online or visit a Cathay Bank branch.

What do I need to access online banking?

You will need your login ID, password, and a web browser.

Is online banking safe?

Yes, Cathay Bank uses multiple layers of security to protect your information.

What can I do with online banking?

You can view your account balances, transfer funds, pay bills, deposit checks, and more.

How do I view my account balances?

You can view your account balances on the main screen of your online banking dashboard.

How do I transfer funds between accounts?

You can transfer funds between your Cathay Bank accounts by selecting the “Transfer” option and following the instructions.

How do I deposit checks using mobile deposit?

You can deposit checks using the mobile banking app by taking a picture of the check and following the instructions.

What are the fees associated with online banking?

There are no monthly fees associated with online banking. However, some transactions, such as wire transfers, may have fees.

How do I view my transaction history?

You can view your transaction history by clicking on the “Transaction History” tab.

How do I cancel a pending transaction?

You can cancel a pending transaction by contacting Cathay Bank customer service.

What do I do if I see a suspicious transaction?

If you see a suspicious transaction, contact Cathay Bank customer service immediately.