Finding your account number on a check is easy! It’s usually located in the bottom left-hand corner. This guide will help you identify your account number and explain what it’s used for. There are three important sets of numbers printed there, each with a specific function. Today, we’ll be focusing on the middle set of numbers, known as your account number.

This unique identifier plays a vital role in your banking activities, ensuring your money goes to the right place when you write a check or set up direct deposit. In the following sections, we’ll delve deeper into how to find your account number on a check, understand its importance, and explore some safe practices for keeping it secure.

What is a Check?

A check (also known as a cheque) is a paper document that instructs your bank to pay a specific amount of money to the named payee (the person or entity you’re paying). To use a check, you’ll need to fill out several fields, including:

- Date: The current date.

- Payee: The name of the person or company you’re paying.

- Amount: The written and numerical amount of the payment.

- Signature: Your signature, authorizing the payment.

What is the Account Number on a Check?

Your account number is a unique identifier linked to your specific bank account. When you write a check, the recipient uses this number to electronically transfer the funds from your account to theirs.

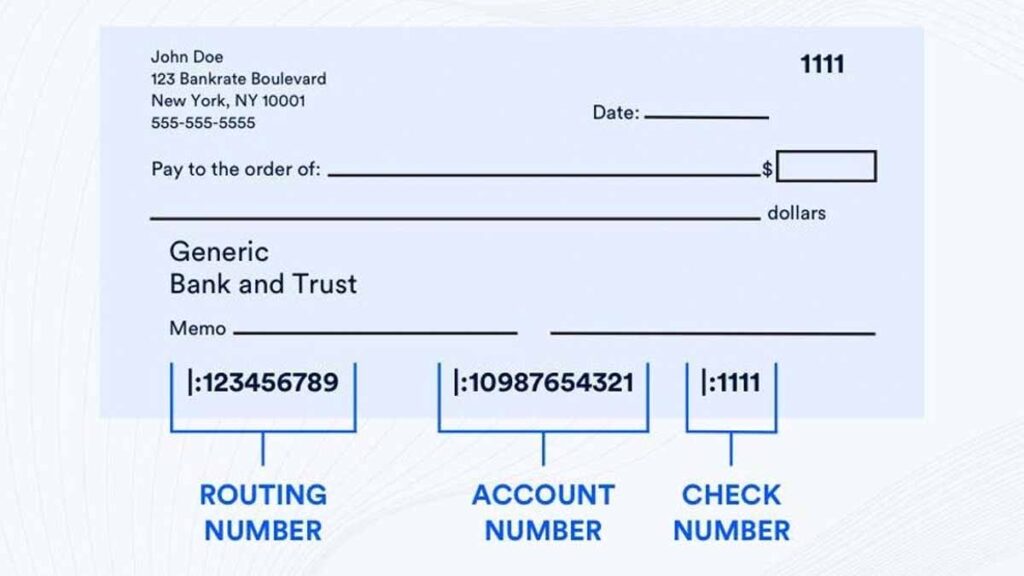

Locating Your Account Number

The account number is printed on the bottom of most checks. Look for three sets of numbers separated by symbols:

- Routing Number (Leftmost): This nine-digit number identifies your bank or credit union.

- Account Number (Middle): This is the number you’re looking for! It’s typically longer than the other two sets, ranging from 10 to 12 digits.

- Check Number (Rightmost): This unique number identifies a specific check within your checkbook.

Finding Your Account Number Elsewhere

Don’t have a check handy? No worries! Your account number can also be found in a few other places:

- Bank Statements: Look for your account number on your paper or online bank statements, usually located at the top or bottom.

- Online Banking: Sign in to your bank’s website or mobile app and navigate to your account details. The account number should be readily available.

- Contact Your Bank: If all else fails, a quick call to your bank’s customer service can get you the information you need.

What if My Check Layout Looks Different?

While the above layout is common, some check formats might have a slightly different arrangement. Here are some variations:

- Business Checks: These might have the company name and address printed at the top, potentially pushing the numbers down slightly.

- Cashier’s Checks: These pre-paid checks won’t have your account number printed since they aren’t linked to your account.

If you’re unsure about your specific check format, consult your bank’s website or customer service for assistance.

When is My Account Number Used?

Your account number is primarily used for two purposes:

- Writing Checks: When you write a check, the recipient uses your account number to electronically withdraw the funds from your account and deposit them into theirs.

- Direct Deposit: If you receive recurring payments through direct deposit (such as payroll), your account number is used to route the funds directly into your account.

Is it Safe to Share My Account Number?

Generally, it’s safe to provide your account number on a check to reputable businesses you’re paying. However, be cautious about sharing your account number in these situations:

- Over the Phone or Email: Never give out your account number over the phone or email unless you initiated the contact and are confident you’re dealing with a legitimate company.

- Online Transactions: Reputable online stores will have a secure checkout process where you enter your account number directly. Avoid entering your account number on non-secure websites.

Security Tips When Using Checks

While checks are a traditional payment method, it’s important to be mindful of security:

- Never write checks to someone you don’t know or trust.

- Don’t share your account number with anyone unless absolutely necessary. Legitimate businesses won’t ask for your account number written on your check for standard transactions.

- Consider using online bill pay or direct deposit for recurring payments whenever possible. These methods offer greater security and convenience.

- Report lost or stolen checks to your bank immediately.

FAQs About Account Numbers on Checks

Is my account number the same for all my checks?

Yes, your account number is unique to your specific bank account and remains the same across all your checks for that account.

Is it safe to give out my account number?

Generally, it’s best to avoid sharing your account number openly. Only provide it to trusted sources for purposes like setting up direct deposit or making online payments to reputable companies.

What’s the difference between an account number and a routing number?

Your account number identifies your specific account within a bank, while the routing number identifies the bank itself. Both are needed for electronic transfers or depositing checks.

Can I have multiple account numbers on one check?

No, a standard check will only have one account number associated with it. However, some businesses may use pre-printed checks with a pre-populated account number.

Conclusion

By following these tips, you can easily find your account number on a check and understand how it’s used. Remember to be cautious about sharing your account number and prioritize secure payment methods whenever possible.